The Investor and Psycho Cycle

The investor cycle

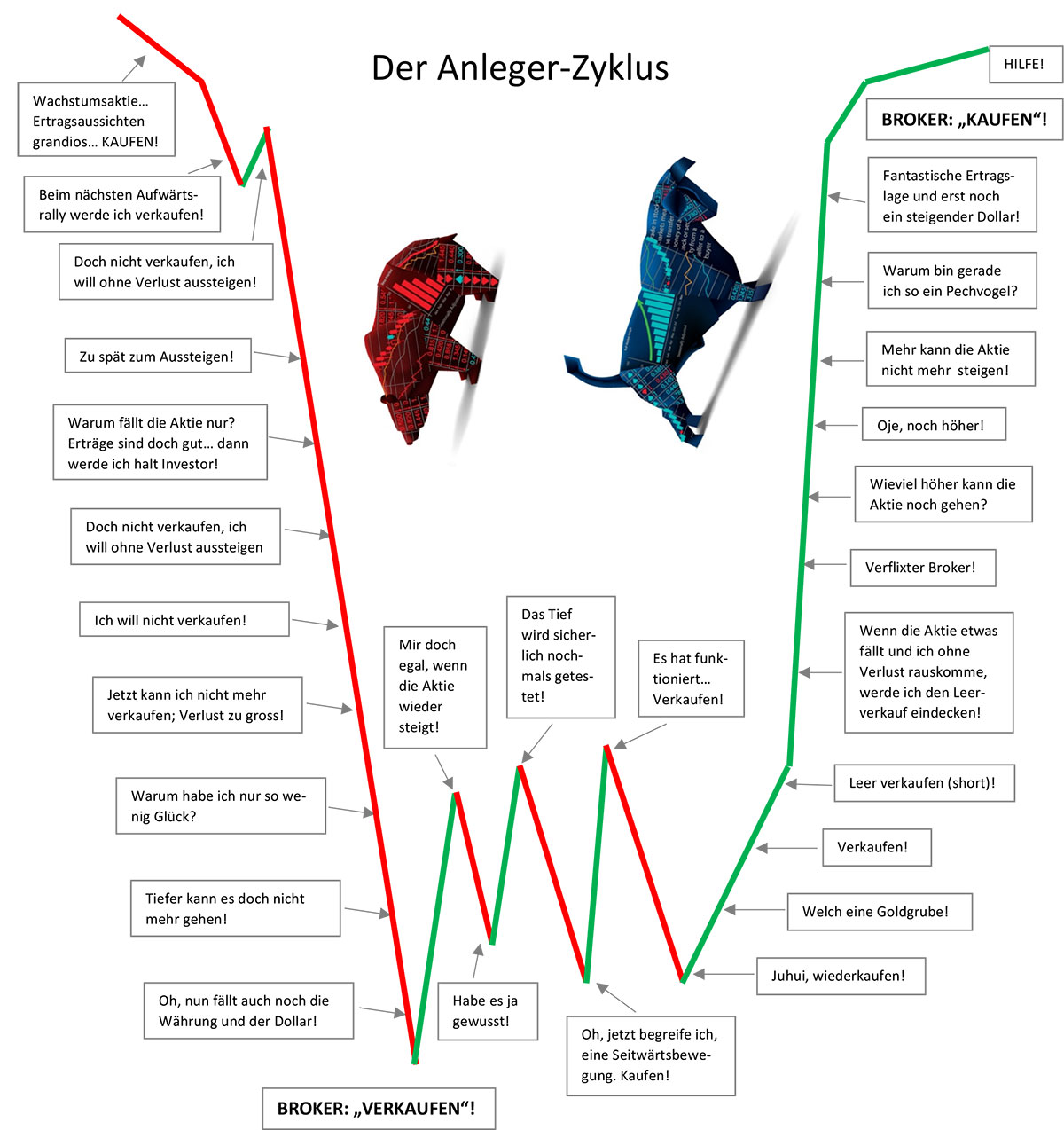

"Ages ago" we illustrated the investor cycle in the WIRTSCHAFTSINFORMATION. It's an old classic that has lost none of its basic meaning. Although, in today's rather confused times, with exorbitantly high debt ratios (private households as well as public sector), unpredictable political bodies/parties, ultra-low interest rates, trade disputes among countries, protectionism, long overblown regulation, globalization, etc., many "long-established", tried and true market mechanisms seem to be... and often are!

Does the more psychologically driven investor cycle still hold up to these realities? By and large, we think so: Yes! Certainly it is not wrong to put the chart shown on page 2 on the desk from time to time and to compare the chart line with the current stock market level, the past facts as well as the upcoming tendencies.

We would like to point out that this is not an actual guide for a concrete investment decision. We also do not link any guarantee with the development curve that the stages drawn in will take place in this order. Nevertheless, one will always find oneself at one stage or another, at least in one's mental perception.

The development curve also confirms that anti-cyclical behaviour can certainly pay off. In any case, in a bull market it is often easy to convince investors to buy a "promising" stock. But who is prepared to buy at sell-off prices! So in very volatile or uncertain phases, the investor cycle can definitely be a help. It is just important not to overestimate it. Convince yourself in the course of your investment transactions whether and when the cycle was or is reliable.

The Psycho Cycle

For some investors, the stock market becomes a permanent "game of chicken" or even a "psycho trap". If the markets or individual parts of them move upwards, one is often underinvested. If the stock market falls, the portfolio is usually too large in one's own perception.

If the logic is impressively clear, it often yields little. If, however, one has an intuitively correct feeling, there is often a lack of plausible arguments for a convinced "getting in". And if "jubilation" or "panic" break out on the stock market, it takes almost superhuman strength not to be carried away by the respective mood... well, with jubilation things are much easier... unless you are a short seller. The latter, by the way, is only recommended for well-funded professionals.

In the market, "P.O.M.P." always applies, i.e. the "principle of (of) minimum profit": by far the largest number of market participants should "get away" with the smallest possible benefit. The market is stingy per se and it does not want to give away much, if possible. The stock market involves a lot of psychology. For example, "MJT - Moral Judgement Test (moral judgement, decision and action)" is considered to be the most important psychological factor influencing price movements. Of course, economic realities are also reflected in the psychological view with a high weighting. But depending on the mood, these are evaluated one way and another. It is well known that bad news from a company can lead to rising or falling share prices, depending on the mood and apart from the fundamental outlook.

The MJT signals result from the formation of three mathematically derived oscillators (state variables). The price trend is broken down into small, medium and larger waves, which are typical for different groups of buyers and sellers: First wave = traders, second wave = institutional and third wave = the general public. So, does this MJT insight help us now? Hardly. Even if one were clear about the psychological findings, the stock market and investment decisions will always remain "unpredictable" to a certain extent. Nevertheless, a short excursion into the world of the investor psyche is to a certain extent exciting... and perhaps it will help you to focus a little more finely on upcoming investment decisions?

Now, below is the visual investor cycle with 7 market sentiments summarized. From bottom to top: Disgusted, Cautiously Optimistic, Optimistic. On the top: convinced. From top to bottom: confidently confident, worried, capitulation.

The Swiss stock market letter WIRTSCHAFTSINFORMATION

- Every 14 days 10-12 pages of stock market tips for shares, precious metals and commodities

- Profit, risk assessment per stock recommendation

- Editorial with market assessment

- Actively managed sample portfolio

- Stock market tips + stock recommendations formulated in an understandable way

- Advertising-free, independent and objective To thereading sample